Keep Property Taxes in Check

LEGISLATION

SB 181/AB 197

This bill allows for the creation of a regional emergency medical services system, and creates a levy limit exception, effectively eliminating the opportunity for the property taxpayers to have any decision making in automatic property tax increases.

Wisconsin property taxes are the 8th highest in the nation. Housing affordability in Wisconsin is closely tied to property taxes, which can alleviate or exacerbate the financial burden on homeowners. High property taxes not only make it harder for families to afford their homes, but they also create barriers to homeownership and hinder job growth.

These rising costs are burying:

-

Seniors on fixed incomes

-

Working families

-

First-time homebuyers

-

Farmers

-

Small businesses

Among Midwestern states, Wisconsin has the second highest percentage of homeowners across all income levels who are extremely cost burdened. Only Illinois ranks higher than Wisconsin.

In 2011, Wisconsin imposed a local property tax levy freeze, saving Wisconsinites over $14 billion in property taxes. If local governments or school districts wish to increase the levy limit, they must seek approval from voters via referendum. These referendums have a high passage rate, with more than 65% passing. While some question the process, many advocate for greater transparency regarding how property tax increases will impact homeowners in both the short and long term.

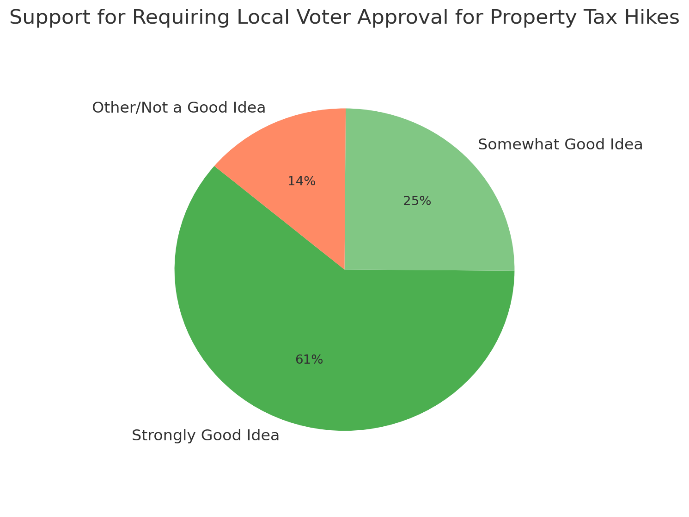

Recent statewide polling shows that 86% of Wisconsinites support required local voter approval for property taxes hikes. And anywhere between 66-77% oppose removing the referendum requirement to increase property taxes regardless of the reasons including transportation, EMS and education.

Fund Schools – Don’t Increase Property Taxes

If the state doesn’t fully fund K-12 schools in the 2025–2027 budget, property taxes will increase automatically.

A veto in the 2023 state budget created a $325 per-student funding increase every year, indefinitely.

If the state fails to provide that amount in each budget cycle, the cost shifts to local property taxpayers, with no referendum and no vote.

This move bypasses the local referendum process that gives voters a say in whether their property taxes should increase.

Depending on a property’s value, taxes could rise by more than $300 in just two years. And that’s in addition to any property tax increases already approved by referendum, or ones that may be proposed in the future.

Don’t Lift the Levy Limit

Senate Bill 181 and Assembly Bill 194 would allow automatic property tax increases, without voter approval. Under these bills, communities that form a regional emergency medical services (EMS) system would be exempt from existing levy limits, enabling them to raise property taxes without going to referendum.

This change eliminates voters’ right to decide whether their property taxes should increase.

We strongly support funding critical services like EMS, but not by bypassing voters or adding to the already heavy burden of property taxes.

Ultimately, this legislation takes away local control and adds to the growing property tax burden on homeowners, small businesses, and farmers.

Loosening levy limits will only worsen Wisconsin’s affordability challenges and make it harder to attract and retain skilled workers across the state.